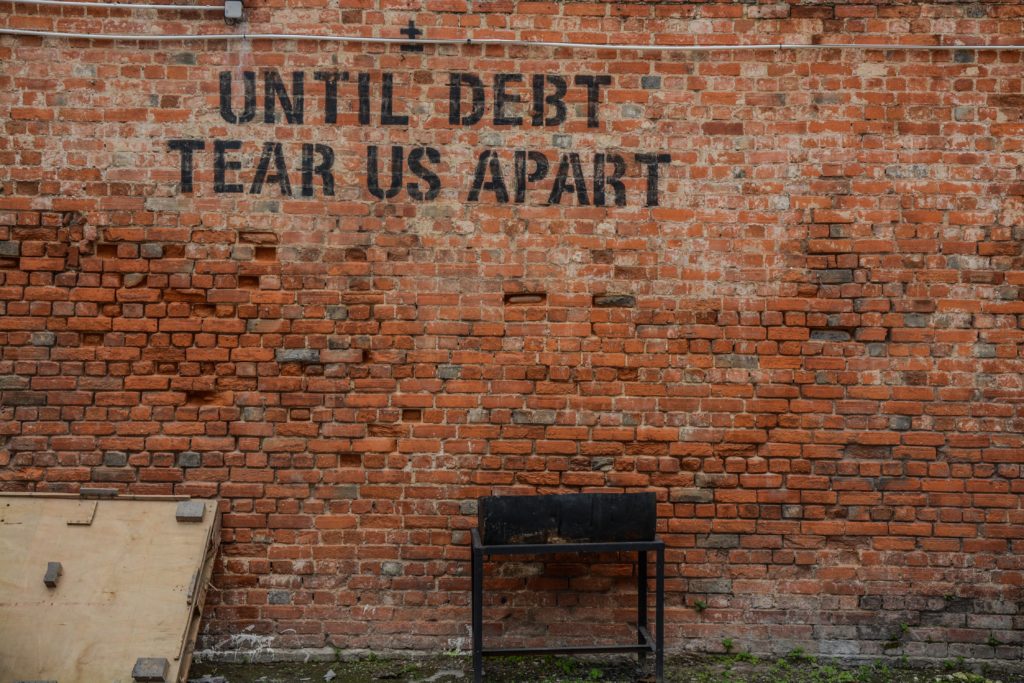

In the case of delinquency or bad debt from residents in your community association in South Florida, you have rights and you have options.

The first thing to note is the order of escalation, depending on the situation, which is as follows:

1. Check your declaration

The Declaration of Covenants, Conditions and Restrictions (CC&Rs) is in place to govern the rules and restrictions of homeowners. This is your first defense against delinquencies and bad debt.

2. Interest

Delinquent interest is another method to put pressure onto an unpaid account. The board is allowed to charge interest at its discretion, according to bylaws in place.

3. Late Fees

You are able to assess late fees. Note the stipulations written into your CC&Rs and institute late fees accordingly.

4. Lien the property

Liens, essentially, tell the world that a debt is overdue and can be a crucial motivator for delinquent payments. The only way to get the lien removed is to pay what is owed.

5. Foreclose and taking possession of the property

If steps 1-4 have not been enough to rectify the situation, the final step is the most drastic. Again, if you have followed the regulations and laws, this is your last move. Hopefully it won’t have to come to this but know that foreclosure is within your rights.

(And if you don’t like the process outlined in your CC&Rs, that too can be changed as long as you go through the appropriate process to amend your CC&R. If you have any questions about how that process works, contact an experienced community association attorney to have them guide you through the process)

Contact us now if you have questions regarding your real estate or community law rights.

Good site yoou hage here.. It’s hard to fihd quality writinmg like yourds nowadays.

I really appreciate individuals llike you! Take care!!

Alsoo visit mmy website – cableavporn.com